INTEL INJECT: Inflation comes in at 8.5% - Markets in Slight Euphoria

Is it too soon to celebrate...?

Welcome back Investors.

We’re officially starting a new “series” dubbed INTEL INJECTS. An Intel Inject is a military concept, where intelligence analysts would quickly deliver new, ad-hoc intel insights to maneuver elements. This was to help ensure of the success of an operation, and limiting of any friendly casualties. Our goal is to more often post smaller injects of data-points and analysis to better serve you as you maneuver the investing landscape.

So without further ado - let’s get after it.

Sponsored Links -

Crypto.com Referral! - Buy, Trade, Sell and HODL Crypto with ease and security. Use our link and referral code to get a free $25 bonus!

https://join.robinhood.com/prestoe126/new-customer-referral-cash-reward - Hey! Robinhood is running a promo—you can earn up to $600 when you sign up and get approved by August 17 and make deposits by September 16. Trade Stocks and Options like a pro here!

Join the Ares Brotherhood Here! (Discord) - You’ll get immediate access to a powerful network of equity and crypto investors, on a journey to financial freedom and wholistic self-improvement! Discord will be free entry for a limited time, or only to paying Substack members.

PATREON - https://www.patreon.com/prestoneckhardt (Coaching and Surgical Analysis by request)

Inflation and Market Updates

Official CPI for July (YOY) came in at 8.5% this morning. This was much less than expected, certainly lower than the previous month which came in at 9.1%. Both Crypto and Capital Market investors took this as an extremely positive sign, and responded in-kind as strong bullish volume floods blue-chip underlyings. Many seem to believe that inflation has peaked, and that the downside has already been priced-in to the markets. But has it really, though?

In our previous letter, you may recall we discussed the current rally to be that of a bear market rally. As of now we still stand by that. Smart Money Hedge Funds are mostly in cash - sitting at 1% wins over the last quarter. This means Hedge Funds and other large institutions are waiting for the final (third) leg of capitulation. If stocks remain in a cyclical bear market, then we’re quickly reaching the end of this rally. Furthermore, given how little volume and speculator indicators / sentiment we see in the market, we don’t see any healthy bull market returning right now. In short, more net sellers than are net buyers.

Week 8 S&P500 Chart

You can use this chart as reference for our third leg down thesis. More positive news and macroeconomic data is needed to move the needle here over to bull territory.

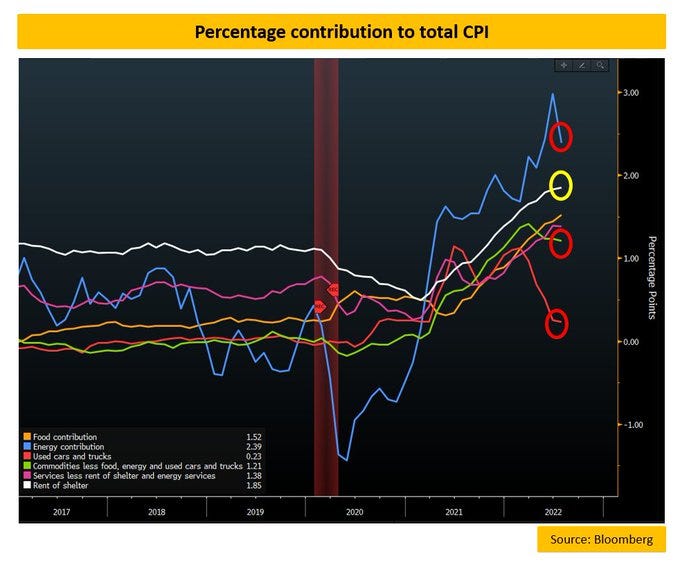

Miscellaneous Commodities (Green) and Energy (Blue) both experienced a significant drop-off. Other previous drivers of CPI prints such as used cars and trucks (Red) are sliding down too. That means that Services, specifically Rent of Shelter (White) now account for a larger portion of inflationary pressures. The July month-over-month print was decent, but recent stats suggest that Rent of Shelter still remains stubbornly high (I’m sure many readers can attest to this).

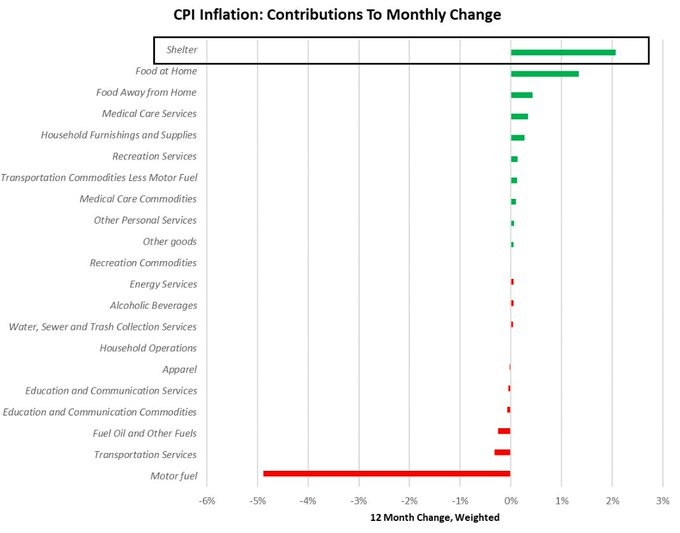

Below is a really good chart detailing CPI Inflation Contributors by monthly change.

Scary, but as you can see Shelter and Food account for a large portion of CPI.

Alf from the Macro Compass made a very good analysis and apropos analysis of the current CPI concerns:

“We need to see a combination of:

Weakness in good prices (likely)

Weakness in energy & commodities

A solid deceleration in the momentum of inflation in core services

@MacroAlf

So that said - we align heavily with Alf here. The potentiality for a soft-landing is there, if the current admin and Fed plays their cards right. Investors are certainly attempting to price that in, given current market conditions.

That being said, I want to take a minute to further clarify the macro and geopolitical environment we’re in. Because, regardless of microeconomic movements, every market is heavily influenced by macro/geopol. events.

Warning: Geopolitical and Macro Analysis below - if you define yourself as “far-left” or “far-right” you will find no value below unless you are capable of critical thinking.

Russia/Ukraine conflict is still raging, and will continue to rage. There is rhetoric of nukes but we dismiss most of that as political positioning on the world stage. However, Russia is intent on domination of Ukraine, and is rallied under Putin to do so despite short-term pains. Think of our involvement within Afghanistan and Iraq, how Russia had direct ties to Taliban and was funding them with weapons & equipment with the proxied intent to harm US troops. We’re using the same exact playbook.

China/Taiwan tensions are rising very quickly. China has been taking notes on Russia’s most recent invasion, and has all the backtesting to execute a successful “peacekeeping operation” against their neighbors. Don’t believe me? Factor this into the calculus - Putin deliberately waited to invade Ukraine. Why? Did the weather just so happen to align with his goals? Did the astronomy line up just right? No. The fact is, and few realize this yet:

America is at an incredibly weakened state right now from a leadership (politics) standpoint, militarily (Equal Opportunity and "Woke” narratives are destroying previously valued Tactical Elements) and internally (perceived racial and social injustices divide Americans).

Regardless of your political ideology - these are the facts. We are a divided and weakened nation. A generation of people oblivious to much of the world around them, glued to their social media and divided by political theatrics that ultimately do not matter. China has an incredible window of opportunity to seize more surface area on the world stage and that is exactly what they are doing. Why wouldn’t they…?

That being said, we should prepare for more pain in the markets. We need to frame our investment theses with various potential outcomes. Worst case scenario is that China proceeds to invade Taiwan, America is forced to respond with various sanctions and proxy-fund countermeasures. This will only further damage the US economy (over-spending). And could be what puts us in another extended bear market.

Capital Allocation in Unprecedented Times…

Okay so the world is falling apart, what do I, as an independent investor looking to grow / preserve wealth go? Truthfully there is no safe answer. Right now there are many options for making money, but long-term preservation is never a guarantee.

We are positioned long-term (in this order) into:

Bitcoin

Ethereum

High-Conviction, World Impacting Stocks (Tech, Genomics, Space)

Tesla, Amazon, Palantir, Microsoft, etc.

Many of ARK’s ETFs - ARKG, ARKX, ARKQ

Dividend Paying Stocks (Passive Income + Theta-Based Options Strats)

Diversified DeFi, GameFi and DarkFi (XMR mostly) Crypto Protocols to attain massive yields and long-term capital gains.*

We are most bullish on Bitcoin, Ethereum, GameFi, DarkFi and life-changing tech companies. The reality is that despite inflation, war, civil unrest, etc., we see overarching themes that are poised to dominate life as we know it moving forward. We are living in a truly beautiful era of technological innovation, and should capture the upside early.

Get after it, stay disciplined, and be vigilant.

PJ

Not Financial Advice. Please conduct your own due diligence before entering any trades or investments.

Bitcoin is extremely expensive for new comers , would ETH be our priority or is there any cheaper coins that y’all recommend?