Welcome back Investors.

We temporarily paused our Substack operations to develop our cutting-edge AresGPT bot, designed to empower our subscribers in generating exceptional returns by harnessing our in-house AI solution. Embracing the mission of making exclusive stock, crypto, and geopolitical intelligence accessible to all, we recognized the significance of crafting our own AI-based trading and researching assistant to bring immense value to our subscribers. If you aspire to elevate your trading and research skills, we invite you to explore our primary website (www.aresinvesting.com) and become a valued subscriber!

We’re going to do our best moving forward to have a better cadence to publishing our Substack articles that are useful in understanding the Matrix, but also generating returns in capital markets. That being said, let’s jump in.

Reminder the purpose of Intel Injects is to summarize salient topics and distill them into some form of actionable insight. AresGPT and our Analysts present the data, and it’s totally up to you what you decide to do with it. There are hundreds of ways to capitalize or hedge given a particular set of information. Position yourself according to your risk appetite.

Stock Intelligence -

Per Preston’s latest video here, we are still cautiously positioned across strong companies with strong balance sheets that will weather the coming storm. Furthermore, we are allocating heavily toward commodities (Gold, Lithium specifically), high-dividend yielding stocks, Military Industrial Complex, Bitcoin Miners and TSLA 0.00%↑ . We also have our “Chaos Hedges” like SEF 0.00%↑ . Be sure to keep up at our YouTube and Rumble Channels respectively to stay up to date on our small account challenge and other data points.

Dangers of looming US Debt Ceiling Crisis:

The US government is expected to hit its debt ceiling on October 18, 2023.

If the debt ceiling is not raised, the US government will be unable to pay its bills and will default on its debt.

A default on US debt would have a devastating impact on the US economy and the global economy.

The US government is likely to reach a deal to raise the debt ceiling, but the deal could come with a high price tag.

The deal could include spending cuts, tax increases, or both.

The deal could also include reforms to the debt ceiling process.

The debt ceiling is a relic of the past and should be abolished.

The article goes on to say that a default on US debt would have a number of negative consequences, including:

A decrease in the value of the dollar

An increase in interest rates

A decrease in economic growth

A decrease in consumer confidence

A decrease in investment

A decrease in job creation

A decrease in tax revenue

The article concludes by saying that the debt ceiling is a dangerous and unnecessary obstacle to the US government's ability to function. The article urges the US government to abolish the debt ceiling and to find a more responsible way to manage its finances.

Jamie Dimon and other top bank execs met with Senate Majority Leader Chuck Schumer yesterday to discuss the debt limit.

After the meeting, Dimon said the US “probably will not default”. (Bullish?)

Real Estate / Home Builder Data:

The construction of new homes in the US increased in April, rising 2.2% to an annualized rate of 1.4 million.

The gain was driven mainly by growth in the number of single-family homebuilding which rose by the most all year.

On the other hand, building permits—a proxy for future construction—fell 1.5% for the second consecutive monthly decline.

Total levels of housing starts and building permits are currently back down to pre-Covid levels.

Keep an eye on construction jobs, which remain elevated despite the decline in new home construction.

US commercial real estate (CRE) prices have fallen for the first time since 2011.

The drop was less than 1%, but it foreshadows additional headwinds for regional banks which hold significant amounts of CRE loans.

Additional declines in property values would add more pressure to an already vulnerable sector.

In Q4, banks held over 60% of the $3.6 trillion in outstanding CRE loans

Useful Data Points:

Corporate Lobbying / Congress Insider Intel:

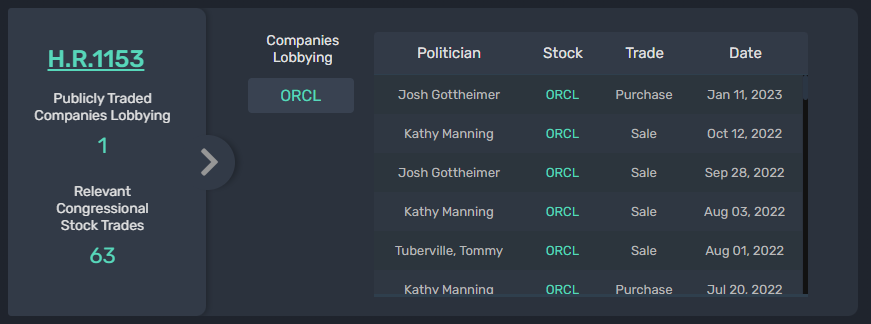

H.R.1153 - DATA ACT BILL - 16MAY2023

Publicly Traded Companies Lobbying - 1 ORCL 0.00%↑

H.R.1640 - SAVE OUR GAS STOVES ACT - 12MAY2023

Publicly Traded Companies Lobbying - 6 CMS 0.00%↑ , CNP 0.00%↑ , ETR 0.00%↑ , HIG 0.00%↑ , OGS 0.00%↑ , XEL 0.00%↑

Crypto Intelligence -

Our portfolio hasn’t changed much, we’ve just conducted some rebalancing. We still hold majority $BTC , GameFi, $XMR and various DeFi protocols for yield.

The global crypto market cap is $1.13 trillion, with a 24-hour volume of $31.38 billion. The price of Bitcoin is $27,140.09, and BTC market dominance is 46.5%. The price of Ethereum is $1,811.21, and ETH market dominance is 19.3%. The best-performing sector is Yield Farming, which gained 12%. The Crypto Fear & Greed Index is currently Neutral (51).

Bitcoin Update:

Bitcoin exchange balance falls below 12%; this was first achieved at the beginning of 2023.

We now see substantial coins leaving exchanges; the equivalent 12% is 2.3 million Bitcoin.

Binance holds roughly 3.5% (686,000), while Coinbase holds 2.3% (461,000).

The black lines represent halvings, with the next halving approaching April 2024; this current halving is the first time we see a drop in exchange balance.

The Bitcoin halving is a scheduled event in which the reward for mining a block is cut in half.

The next Bitcoin halving is scheduled to occur on May 10, 2023. (Less than 50,000 blocks remaining)

The Bitcoin halving has historically been followed by a significant increase in the price of Bitcoin.

There are a number of factors that could contribute to a price increase after the Bitcoin halving, including:

Reduced supply: The halving will reduce the supply of new Bitcoin that is being mined, which could lead to an increase in demand.

Increased demand: The halving could lead to increased demand for Bitcoin as investors seek to acquire the asset before the supply is reduced.

Increased institutional adoption: Institutional investors have been increasing their exposure to Bitcoin in recent years, and the halving could lead to further adoption as institutions seek to gain exposure to the asset.

SEC, CBDCs, Regulatory Oversight:

The Securities and Exchange Commission (SEC) has denied a spot Bitcoin ETF application from Grayscale Investments (once again).

This is the second time that Grayscale has had its spot Bitcoin ETF application denied by the SEC.

The SEC has not provided a reason for its decision, but it is likely that the decision was based on concerns about the risks of fraud and manipulation in the Bitcoin market.

The denial of Grayscale's application is a setback for the cryptocurrency industry, as it was seen as a major step towards the legitimization of Bitcoin.

However, the industry is still growing and developing, and it is likely that a spot Bitcoin ETF will eventually be approved by the SEC.

Here are some additional thoughts on the article:

The SEC's decision to deny Grayscale's application is a disappointment for the cryptocurrency industry, but it is not a surprise. The SEC has been reluctant to approve spot Bitcoin ETFs, and it is likely that the agency will continue to be cautious in this area.

The denial of Grayscale's application is a setback for the legitimization of Bitcoin, but it is not a death blow. The cryptocurrency industry is still growing and developing, and it is likely that a spot Bitcoin ETF will eventually be approved by the SEC.

The SEC's decision to deny Grayscale's application is a reminder that the cryptocurrency industry is still in its early stages of development, and that there are “risks” associated with investing in Bitcoin. However, the industry is growing and developing, and it is likely that Bitcoin will become a more mainstream asset in the future.

SEC deems Filecoin a security

Ray Dalio and Debt Ceiling Insights -

Legendary Investor Ray Dalio recently put out another insights article covering the debate between Democrats and Republicans over the debt ceiling. Dalio argues that the debt ceiling is a dangerous game of brinkmanship that could lead to a financial crisis. He also argues that the only way to solve the debt ceiling problem is to reform the way the government budgets.

Dalio begins by explaining that the debt ceiling is a limit on the amount of money the United States government can borrow. He then goes on to say that the debt ceiling has been raised 78 times since 1960. Dalio then argues that the debt ceiling is a political issue, and that both parties have used it as a bargaining chip in the past. He also argues that the debt ceiling is not a fiscal issue, and that raising the debt ceiling does not increase the deficit.

Dalio then goes on to say that the debt ceiling is a dangerous game of brinkmanship. He argues that when the government comes close to defaulting on its debt, it can cause a financial crisis. This is because investors lose confidence in the government's ability to pay its debts, and they start to sell off their investments. This can lead to a decrease in the value of the dollar, and it can make it more difficult for the government to borrow money.

Dalio then concludes by arguing that the only way to solve the debt ceiling problem is to reform the way the government budgets. He argues that the government needs to find a way to control its spending, and it needs to do so in a way that does not require raising the debt ceiling. This will require a bipartisan effort, but it is essential if the US government is to avoid a financial crisis.

Here are his final thoughts on the Debt Ceiling Crisis:

The debt ceiling is a relic of the past. It was created in 1917, when the US government was still relatively young and inexperienced. At the time, the government was worried about going into debt, and the debt ceiling was seen as a way to prevent that from happening.

The debt ceiling is no longer necessary. The US government is now one of the largest and most powerful economies in the world. It has a long history of paying its debts, and there is no reason to believe that it will not continue to do so.

The only way to solve the debt ceiling problem is to reform the way the government budgets. The government needs to find a way to control its spending, and it needs to do so in a way that does not require raising the debt ceiling. This will require a bipartisan effort, but it is essential if the US government is to avoid a financial crisis.

That wraps up today’s inject, be sure to sign up and join 2,000 other investors at www.aresinvesting.com to achieve tactical clarity and massive success.

Stay disciplined, do the hard work, talk soon.

PJ / AresGPT