ETHEREUM ETFs APPROVED...! Was it Already Priced In? SOL ETFs Next?

5/25/24 Intel Inject - DeFi & Crypto Moves for the week.

Welcome back, Investors, Cryptopreneurs and DeFi Enjoyers!

It’s definitely been a crazy week for Crypto Markets! The floodgates are opened as Ethereum ETFs have been approved. If you’ve been living under a rock for the last week, (or been on vacation 😎) here’s what you missed!

8 Ethereum ETFs have been granted initial approval! 🎆

Trump Campaign taking Crypto Donations; pledges to “[…] keep Warren and her goons away from your Bitcoin [Crypto]!” 🥊

Trump also vows to free Ross Ulbricht..!

Bitcoin ETF products saw net inflows of over $950M the last week! 📈

$NORMIE Memecoin exploited, millions lost. 📉

The State of Wisconsin Investment Board bought $100M of Bitcoin ETFs! 🏛️

Ethereum HODLing metrics indicate over 80% unmoved for 6+ months! 💰

As always, our trades are posted towards the end of each segment!

Okay now that you’re caught up, let’s dive into the intel.

BLUF (Bottom Line Upfront) 👨🏫

Okay it’s obvious the Ethereum ETFs were somewhat priced in, what can we reasonably expect to come next? Surprise - We’re going Long.

Is Altseason on the near-term horizon?

Is a Solana (SOL) ETF on the horizon..?

As assessed, BTC is playing within strong liquidity zones and is playing out our primary, bullish scenario perfectly. ($74k-$75.5k next)

Trump is dominating the Crypto Voter demographic, Biden and friends know this, which means they might double-down on attacking Crypto. They hold well over $15B in various Cryptocurrencies (mostly BTC). With enough coordination and resources (of which there are many), the current admin could orchestrate some serious damage leading into the election.

Geopolitical Risks to Crypto - China increasing frequency of military drills around Taiwan + US Military Industrial Complex ramping production of special operations equipment.

$BTC, $ETH and Altcoin Macro Moves

It seems like just yesterday major institutional players were calling for BTC, ETH, etc. to zero. Now we’ve not only passed BTC ETFs but also ETH ETFs!

So that’s great and all, but how should we be playing the markets? And more importantly, let’s discuss our forward guidance as we move into the second half of the bull market.

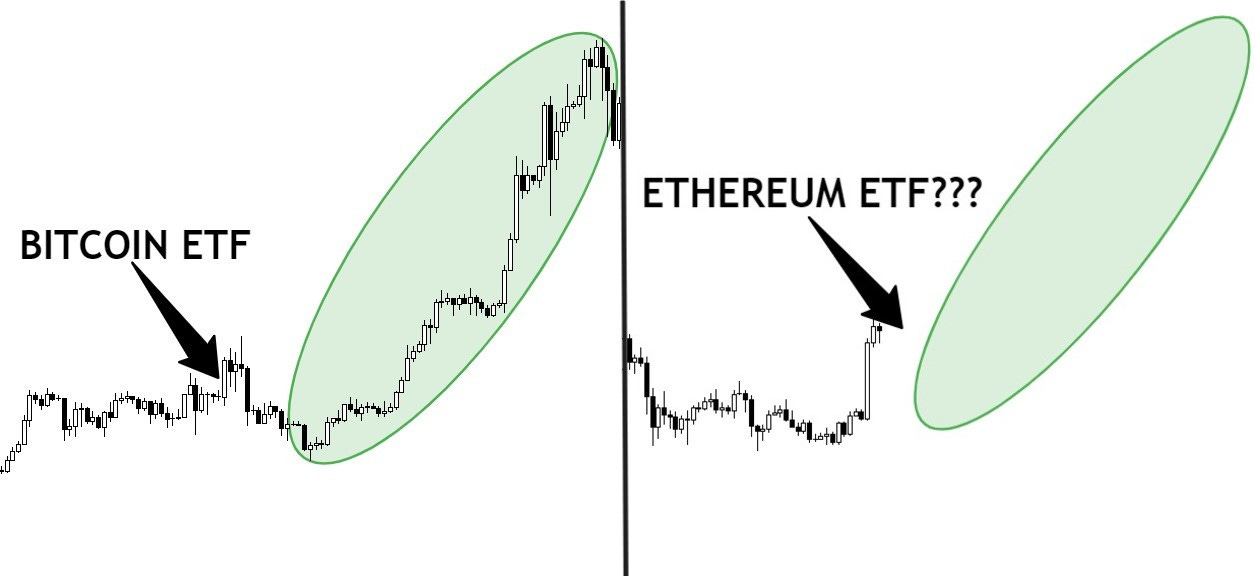

Before diving further, please study the following chart art:

It goes without saying that we will see (and have already seen) some slight retracement post announcement. This is exactly what happened after the BTC ETF announcement.

With BTC moving fluidly through our primary bullish scenario, we’re reminded of a certain Crypto Cycle Chart:

We see $BTC shooting up to $74k-$75k range in the near-term, and have already established long-levered positions within the latest retracement. We also used this as an opportunity to DCA into $BTC, and other high-conviction blue chips, altcoins and microcaps. ($SOL, $SUI, $STX, $WIF, $ZYN, and some degen-level microcaps)

As $BTC consolidates to break into our price target, $ETH will naturally follow suit beyond $4k (very likely), and then altcoin season rolls in heavy.

(Wealth trickle-down effect dictates - BTC/ETH gainers sell their short-term winning positions and roll that into stables and altcoins)

Additional bullish indicators to consider:

Ethereum HODLers increasing massively - over 80% unmoved for 6+ months

Top-performing TradFi Wealth Managers calling for $6600 ETH price targets after ETH ETF approval.

FIT21 passes House

Anti-CBDC Bill pass House

Treasury Buyback announced $2B a week

With the Crypto Cycles chart fresh in mind, here is some more analysis on ETH + Altcoins:

PJ no one cares about your magical charts, just give us the alpha…

Okay so long story short, if ETH continues to consolidate in the current range, and

Keep reading with a 7-day free trial

Subscribe to The Ares Crypto INTSUM to keep reading this post and get 7 days of free access to the full post archives.