Welcome back, investors!

We’ve revamped our newsletter to be more quick-hitting, colorful, and “ADHD-Friendly” digestible! Our goal has always been to combine strategic and tactical - level trade intelligence to help guide your investment methodology. However, the read-through rate for our analysis-heavy research was very low. So from now on we’re just going to give the Alpha, cut the bloat and have fun with it. Let’s dive in!

BLUF (Bottom Line Upfront) 👨🏫

Keith Gill (@TheRoaringKitty) aka “DFV”, aka “The Hero of the Retail Trader” is back… or at least we think so. Keith has been posting a series of cryptic short-videos on his X/Twitter that have sparked renewed interest in GameStop, AMC and other memestocks/coins. 🐱👓🎮

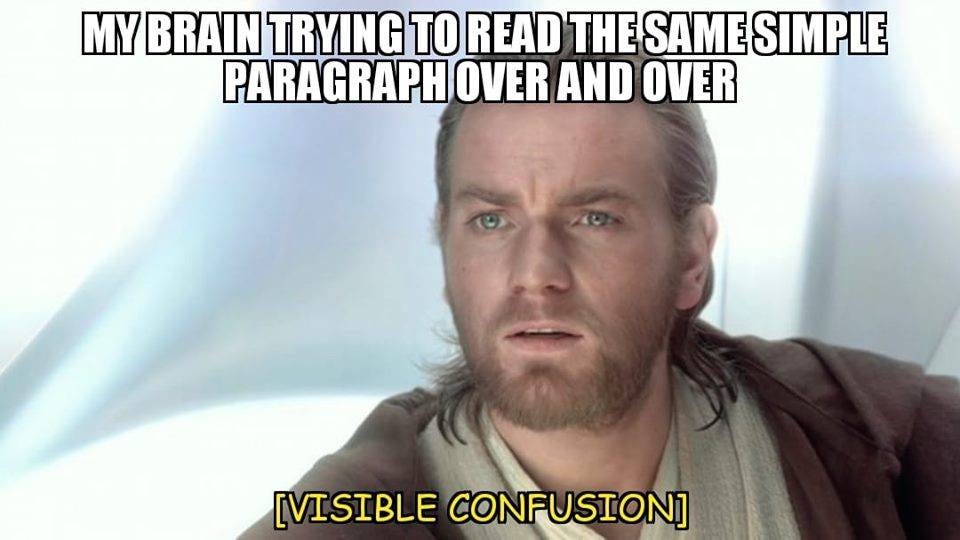

Bitcoin entering strong liquidity zones as seller exhaustion kicks in.

Over $1.35B+ in Altcoin Token Unlocks loom over the horizon - will the altcoin super-cycle really be as “super” as people think?

DeFi in wealth preservation mode 🏧 ; Crypto Trading in greed mode 🤑

Printing 50-60% risk-free in DeFi with Stablecoins 💵

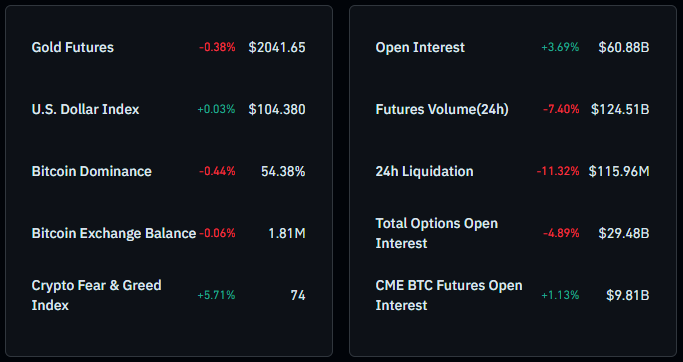

GME 0.00%↑ (Stock) Trade

Having traded the first iteration of the whole “GameStonk” / Memestock debacle of 2021 has afforded us a slight edge. In 2021, large financial institutions and market makers were doing everything they could to keep their massive short positions on GameStop ( GME 0.00%↑ ).

They were essentially shorting GME more than the actual available shares on the public markets had available (financial institutions doing what they do best and manipulating markets 🤗). Keith Gill and the intelligent folks over at the Wallstreetbets subreddit, identified that by buying up massive amounts of GME stock they could cause an intense short-squeeze unlike anything we have ever seen. A MOASS if you will (mother-of-all-short-squeezes). And in 2021, that’s exactly what happened (see chart above).

This time around, the short float isn’t as big as it was in ‘21, but it’s still substantial. Looks like hedgies (hedge funds) and institutions are still short GME and trying to orchestrate its downfall.

Okay, the history lesson is cool and all, but how do we trade this?

Well,

With so many “influencers” rallying behind Keith Gill, we could see another massive short-squeeze beyond what we’ve already seen. This could also be the rallying cry we needed to get retail off sidelines and back into public markets be it Stocks and/or Crypto.

As assessed, GME is breaking market structure. Waiting for retracement to exhaust before buying Call Options.

We’re going long GME 0.00%↑ today late this afternoon, as market makers are likely hunting down stop losses and putting Calls OTM (out of the money) moving into the weekend. Additionally, Gamestop has filed to dump $45M worth of shares on the market in light of their newfound capital appreciation. That being said, $40 and $50 Calls look particularly promising in a sub-30 day expiration timeline. For those of you wanting to lower your total risk exposure, but still want to capture the short squeeze, you could just buy GME shares and hold those. Anything under $18 is decent , under $15 is prime real estate.

GME (Crypto) Trade

Thesis here is somewhat similar to our GME (Stock) play, however we’re buying up the token (on Raydium / Solana) for cheap below $45M marketcap and then looking to scale out over $100M Marketcap.

Risk & Trade Analysis -

GME is a financially unhealthy company - Preliminary Q1 sales fell $892M down from $1.2B last year, and this seems to be a recurring trend. Not sure there’s a ton of long-term value here unless leadership pivots to Web3 Gaming (which they kind of did with Immutable-X but, no major developments yet).

GME already filed to dump $45M worth of shares on the public market. This could be extremely bearish in the short-term, but if social sentiment holds bullish, the trade still lives on.

Famous influencers and KOLs shilling GME is a double-edge sword. You can and should make money as it runs up, but bear in mind that public markets are PVP (player-vs-player), and these influencers WILL dump their shares on you and use you as exit liquidity. DON’T GET LEFT HOLDING THE BAG. Secure gains, maybe leave a runner, and play smart. There is no such thing as “diamond hands” in this zero-sum game that is high-risk trading.

RISK ASSESSMENT 🟠 - 7.5/10, High Risk, Very High Potential Rate of Return, Short-Mid Term Trade

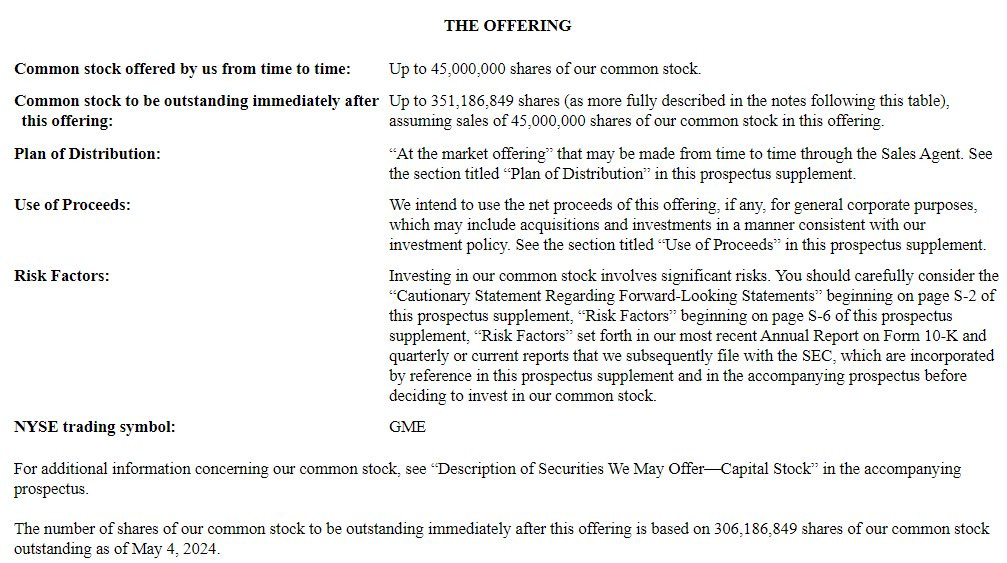

BTC Trade

BTC has entered mass liquidity zone, sellers are exhausted, and a soft CPI print is bullish for risk-on assets. Further, many institutions are releasing 13F filings, indicating continuous increase in BTC ETF holdings:

Beyond that, inefficient, pre-halving miners have finally been culled out of the market, so capitulation is over there. Only makes sense that a rally was imminent:

Last bit of alpha:

Risk & Trade Analysis -

All signs are short-term bullish as BTC hits its liquidity zones. Mean reversion risk increases as we near $71k-$72k.

BTC rising also means that dips are for buying here (in the short term, this holds true).

Macro factors are still a bit hazy for Crypto as far as regulatory oversight goes, need to manage this trade a little more closely as we are in an election year as well.

RISK ASSESSMENT 🟡 - 5.5/10, Mid-Risk, High Potential Rate of Return, Short-Mid Term Trade

SUI Trade

With BTC rallying, the rest of the market is likely to follow. However, with over $1B in altcoin token unlocks over the horizon, we can safely look to enter short positions on select tokens.

SUI has a massive token unlock coming 1JUN2024:

Here’s SUI’s current chart overlaid with chart astrology:

As we can see, SUI is rallying alongside the rest of the market. Token unlock recipients are likely very happy to see this, as they’ll “hopefully” get a better sell basis on their tokens.

Now look I don’t think they’re going to sell the entire allocation, maybe only 20-30% of total unlock, but that’s still substantial sell pressure. We sold our previous short at a decent gain, and will be looking to short SUI again once we see confirmation of a downtrend.

Risk & Trade Analysis -

SUI’s short-term rally will likely be short-lived. This is great for us as traders, as we can look to exploit the upcoming token unlock to short SUI for big gains.

Major risk here is timing risk. We need to ensure that we enter the short position as SUI starts to show signs of weakness (likelihood increases exponentially as the token unlock date nears).

RISK ASSESSMENT 🟢 - 3.0/10, Low-Risk, Decent Potential Rate of Return, Short-Mid Term Trade

DeFi Positioning

For those of you in our community, you already know that we stabled-up much of the fund, with a focus on wealth preservation + decent ROR (rate of return). We’ve slowly been migrating some of our USDC out of Interport, but for those of you that are new here is where we were yield farming for awhile:

That being said, market is showing short-term bullishness, so naturally we are pivoting towards more aggro LPs / Strategies. Right now our algo has moved us back into SUI-USDC on Turbos, 5x Hourly FUD Put Selling Vault on Typus and USDC-AERO Vault on Beefy.

If you’ve been sidelined into stables waiting for a good time to allocate back into DeFi, now could be a great time to switch to aggro strategies and capture some concentrated liquidity ranges.

Well that’s all for today’s issue folks! Let us know what you think about the new format. Again, our goal is be informative, tactically / strategically relevant whilst also having fun with it and appealing to our new, younger audience.

If you’re interested in joining our Ares Trading Community for live-trading, positioning, research and more, be sure to DM us as we don’t have a streamlined platform in which to facilitate this through yet!

Thank you for reading, and stay relentless! 💪

PJ